The Ultimate Guide To Buying Waterfront Property at the Chesapeake Bay

Does this sound like you?

- Should we live on the Chesapeake Bay, or maybe Mobjack Bay?

- Or maybe a river … what is the difference between the Rappahannock, Great Wicomico, Potomac, and Piankatank River? And what about Carter’s Creek, Stingray Point, or Fishing Bay?

- And I hear that Deltaville is a great place, but supposedly so are Urbanna, Gwynn’s Island, and Irvington, too.

- I wonder what the real difference is between Mathews, Middlesex, Gloucester, Lancaster, and Northumberland counties?

- By the way, where does the Northern Neck end and the Middle Peninsula begin?

- How much water depth do I need for my sailboat? Or my kayak? Do I need a dock?

If you’ve ever asked these questions, we can help.

This is Our Home

For many, buying a home along one of the waterways that define Virginia’s Northern Neck and Middle Peninsula represents the attainment of a lifelong dream.

However, purchasing a home along one of our waterways is a bit different than purchasing a home elsewhere. The same forces that drive values in most areas don’t necessarily apply here and making the best decision means understanding nuances and subtleties that aren’t always evident to the untrained eye.

At Bay Properties, we understand the market. We know the personalities of the rivers, creeks, and towns along the Bay, and we know the stories and reasons behind why our market operates the way it does.

Let our knowledge and experience become yours.

Sincerely,

The Bay Properties Team

Table of Contents

Section 1 | Understanding the Chesapeake Bay

If you want to learn more about the region in general, the section on Understanding the Chesapeake Bay is a great place to start. We discuss the difference between the Northern Neck and Middle Peninsula, as well as the counties and towns that populate each.

The searches we offer are broken down by county, town, and price, as well as homes along the water.

Section 2 | Homes Along the Water

Do you want to really dive into your search? Then the Homes Along the Water section of this post is the perfect place for you to start.

We break down the bodies of water –– bays, rivers, and creeks –– as well as some specialty searches for weekend getaways, estates, and lots/land.

Section 3 | It’s A Little Bit Different Here

In the same way that buying a co-op in Manhattan is different than say, buying a home in Fairfax, Virginia, so is buying a home in Mathews or Irvington.

Thus we wrote the section entitled ‘It’s a Little Bit Different Here.‘

We cover the art of buying a home here, from how we help you navigate the multiple MLS’s that cover our region, to the trouble that Zillow and Trulia have with their estimates, to the different types of insurances mandated and inspections required, to a primer on docks.

Every market is unique and ours is no different. We can help you understand just how so.

Section 4 | Securing a Mortgage

In same way our process is different than what most buyers are used to, so is Securing a Mortgage.

When the large majority of homeowners bought their home, they used one of the major conventional mortgage providers to do so (Fannie Mae, Freddie Mac, FHA, VA).

However, when purchasing a 2nd home, or vacation home, the process changes –– especially as it relates to mortgage products.

Don’t be surprised by the differences.

About Us

And if you want to know a little bit more About Us, well, here we are!

Thanks for visiting The Ultimate Guide to Buying a Waterfront Property or Along the Bay!

804.200.5731 or BayProp@BayProperties.com

Understanding the Chesapeake Bay Region

The Northern Neck

The Northern Neck is one of the two primary fingers of land that abuts the Chesapeake Bay on the mainland of Virginia.

Bound by the Potomac River to the north (and east) and the Rappahannock River to the south (and west), the Northern Neck is home to Lancaster County, Northumberland County, and Westmoreland County, as well as the more well-known towns of Irvington, White Stone, Kilmarnock, Warsaw, and Reedville.

Lancaster County

Bordered to the north by Northumberland County, Lancaster County’s 180 miles of shoreline is comprised of the Chesapeake Bay to the east and the Rappahannock River to the south and west. Additional Lancaster County shoreline is composed of the deep waters of The Corrotoman River.

The thriving towns of Irvington, Kilmarnock, and White Stone provide numerous options for dining and boutique shopping.

For more details about Lancaster County, follow THIS LINK.

Driving distance from:

- Richmond — 76 miles (1hr 35min)

- Washington, D.C. — 115 miles (2hr 25min)

- Norfolk — 86 miles (2hr 17min)

Homes For Sale in Lancaster County by Price

A Sample of Homes For Sale in Lancaster County

* Please note that Lancaster County is covered by two MLS’s and thus not all of the homes for sale in Lancaster will appear on this site. For a complete list of homes for sale in Lancaster, please contact us at BayProp@BayProperties.com and we can provide.

Northumberland County

Bordered by the Potomac River to the North, the Chesapeake Bay to the East, Lancaster County to the south, and Richmond and Westmoreland Counties to the West, Northumberland County offers towns, shorelines and activities, within only two hours from Richmond.

Considered one of the more rural counties, it will make for your perfect quiet get away.

For more on Northumberland County, follow THIS LINK.

Driving distance from:

- Richmond — 87 miles (1hr 45min)

- Washington, D.C. — 142 miles (2hr 46min)

- Norfolk — 99 miles (2hr 11min)

Homes For Sale in Northumberland County by Price

A Sample of Homes For Sale in Northumberland County

* Please note that Northumberland County is covered by two MLS’s and thus not all of the homes for sale in Lancaster will appear on this site. For a complete list of homes for sale in Northumberland, please contact us at BayProp@BayProperties.com and we can provide.

Westmoreland County

Settled on the Northern Neck, between the Potomac and Rappahannock Rivers, and in close proximity to Washington, D.C., Westmoreland County offers rich history, beautiful terrain, and an abundance of recreational activities.

Westmoreland County is for those searching for a more rural lifestyle and/or a private river getaway.

To read more about Westmoreland County, follow THIS LINK.

Driving distance from:

- Richmond — 62 miles (1hr 21min)

- Washington, D.C. — 82 miles (1hr 55min)

- Norfolk — 117 miles (2hr 19min)

Homes For Sale in Westmoreland County by Price

A Sample of Homes For Sale in Westmoreland County

* Please note that Westmoreland County is covered by two MLS’s and thus not all of the homes for sale in Lancaster will appear on this site. For a complete list of homes for sale in Westmoreland, please contact us at BayProp@BayProperties.com and we can provide.

The Middle Peninsula

The Middle Peninsula is the southern of the two fingers of land that comprise the Bay Region of eastern mainland Virginia.

Located between the Rappahannock and York Rivers, the Middle Peninsula is home to the counties of Middlesex, Mathews, and Gloucester. Deltaville, Tappahannock, Urbanna, Mathews Village, and Gloucester Village are just a few of the towns that populate the area.

Gloucester County

Sitting between the York River and Mobjack Bay, and situated on the Middle Peninsula, Gloucester County is more commercial than the other counties, yet still offers desirable waterfront property.

Gloucester County has history, shopping, eateries, and breweries, plus numerous options for recreational activities.

To read more on Gloucester County, follow THIS LINK.

Driving distance from:

- Richmond — 59 miles (1 hour)

- Washington, D.C. — 160 miles (3 hours)

- Norfolk — 50 miles (1hr 30min)

Homes For Sale in Gloucester County by Price

A Sample of Homes For Sale in Gloucester County

Middlesex County

Positioned on the Middle Peninsula, Middlesex is situated to the north of Mathews and to the south of Lancaster. One of its most notable geographic features is that Middlessex is cradled between the Rappahannock River to the north and the Piankatank River to the south.

Three of the most notably charming towns in Middlesex County are Deltaville, Topping and Urbanna.

For more on Middlesex and these towns, follow THIS LINK.

Driving distance from:

- Richmond — 55 miles (1hr)

- Washington, D.C. — 133 miles (3hr)

- Norfolk — 66 miles (1hr 45min)

Homes For Sale in Middlesex County by Price

A Sample of Homes For Sale in Middlesex County

Mathews County

Commonly known as the ‘Pearl of the Chesapeake,’ Mathews County is tucked between Mobjack Bay and the Piankatank River.

Offering over 200 miles of Chesapeake Bay shoreline, there are numerous water activities to enjoy, in addition to being home to historic buildings, annual festivals and a strong local restaurant scene.

For more on Mathews County, follow THIS LINK.

Driving distance from:

- Richmond — 71 miles (1hr 20min)

- Washington, D.C. — 173 miles (3hr 10min)

- Norfolk — 65 miles (1hr 40min)

Homes For Sale in Mathews County by Price

- Under $150,000

- From $150,000 to $250,000

- From $250,000 to $500,000

- From $500,000 to $1,000,000

- Over $1,000,000

A Sample of Homes For Sale in Mathews County

The Towns

For most, the idea of spending time engaged with water is the primary draw to our market. Getting away from the hustle and bustle of the city and watching one of our spectacular sunsets with friends and family is unbelievably therapeutic.

But as relaxing as unplugging can be, proximity to services, entertainment, and modern conveniences still serves a purpose. So finding the perfect balance of peace and tranquility, yet with a grocery store and coffee shop nearby, is important, too.

Numerous small towns dot the landscape of the Bay, each with their own distinctive personality.

- Irvington

- Kilmarnock

- White Stone

- Gwynn’s Island

- Urbanna

- Deltaville

- Mathews Village

- Gloucester Village

- Reedville

- Tappahannock

Along the Water

Whether it is the big view across the Rappahannock, deep water access for a sailboat, or just a small put-in for a kayak, proximity to water is one of the primary driving forces in our market.

In the same way that we all have different needs in our houses, most owners here have different water preferences. Understanding what each type of water can provide is extremely important in making the best decision when you purchase.

The Bays

If you love big water views, there is no bigger water than that of the Chesapeake Bay. For those who truly love the endless views and direct access to the depth of the Chesapeake Bay, a home along one of the bays makes sense.

However, if you do decide that ‘big water’ is for you, be prepared that the bigger the water, the more likely you are to experience rougher conditions, stronger currents, and more exposure to the vagaries of Mother Nature.

The Rivers

While a million-mile view across the Chesapeake may be transformative, often times, living along one of the rivers can offer the perfect balance of the big views of the Bay but with calmer water.

Each river in our market provides something a little different, generally relating to width and depth. Your preferred relationship with the water will largely determine not only which river suits you best, but how far up (or down) river you should go in order to have access to the type of water you wish.

- The Rappahannock River

- The Piankatank River

- The Corrotoman River

- The North, East, Ware, and Severn Rivers (off of the Mobjack Bay)

- The Great Wicomico and Little Wicomico

- York River

Noteworthy Creeks

The number of creeks in our region is too many to count … but don’t be fooled by the word ‘creek.’ In our neck of the woods, the word ‘creek’ can mean many things.

Some creeks can provide nothing more than access for a kayak or flat-bottomed fishing boat, while others can handle far bigger craft and take on characteristics more consistent with small rivers.

It all depends.

So don’t discount living along a creek just because it sounds small. Often times, a creek can provide as much enjoyment as any body of water in our market.

Surprisingly, creeks are also a good location for sailboats as they can offer necessary protection and depth.

Specialty Searches

For many, the specific body of water is less important than simply finding the right blend of home, water, and price.

We created several searches for those who don’t necessarily have a specific river that they need to be on, or a specific town they wish to be close to.

- Getaways

- Big Views

- Magnificent Estates

- Lots and Land (if you are considering building a home)

The Process is a Little Bit Different Here

For most of the people who purchase homes along the water, it isn’t their first rodeo. More often than not, those who purchase a home along the water either have previously owned a home or are buying a vacation/getaway home –– and thus are familiar with the buying process.

[su_box title=”A Note About Water Depth” style=”default” box_color=”#333333″ title_color=”#FFFFFF” radius=”3″ class=””]Water Depth is incredibly important to most who buy along big water. We created this water depth map to help show what areas might offer deeper water. It should be noted however that water depths are in constant flux and this chart is no guarantee that the depth demonstrated here is accurate.

For more information, check out our page on Water Depths[/su_box]

However, buying along the water and in areas that are typically more rural, there are several distinct differences that you need to be aware of.

Let’s discuss.

Searching Online

Pretty much everyone begins their home search online these days (and the fact that you are on this website probably indicated that you did, too!)

Why? Because doing research from your home or office is far more efficient than hopping in the car, driving to the area where you think you want to buy a home, and hoping magic happens.

But when you are looking in our market, there are a few things you should understand to really help you hone in on the properties that are best for you.

Difference #1 –– Multiple MLS’s

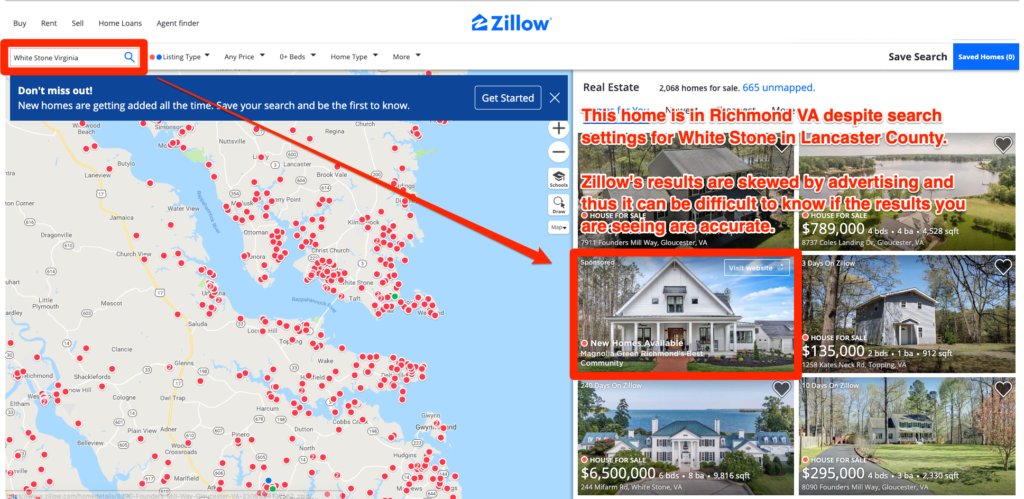

In most major metropolitan markets, a single MLS (Multiple Listing Service or Realtor Database of Homes For Sale) offers coverage of the entire area. And generally, the local MLS is pretty efficient at syndicating listings to the search portals of Zillow, Trulia, and Realtor.com.

That is not how it works here.

The Northern Neck uses one MLS and Middle Peninsula uses another. The MLS that covers the Middle Peninsula works the MLS in Richmond, but not Williamsburg or Hampton Roads.

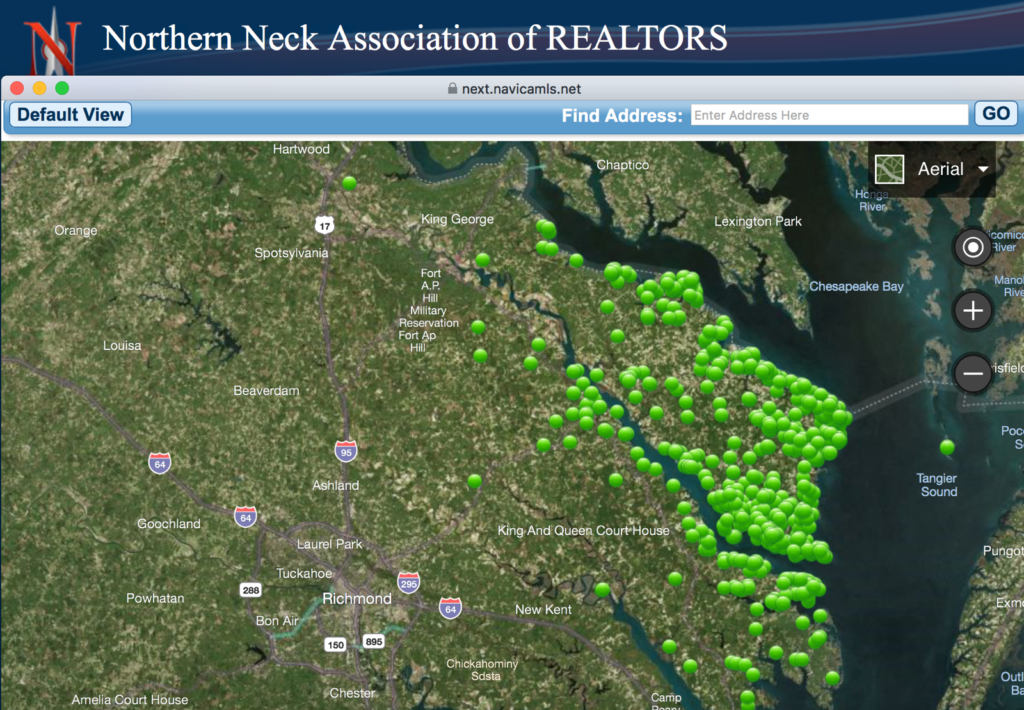

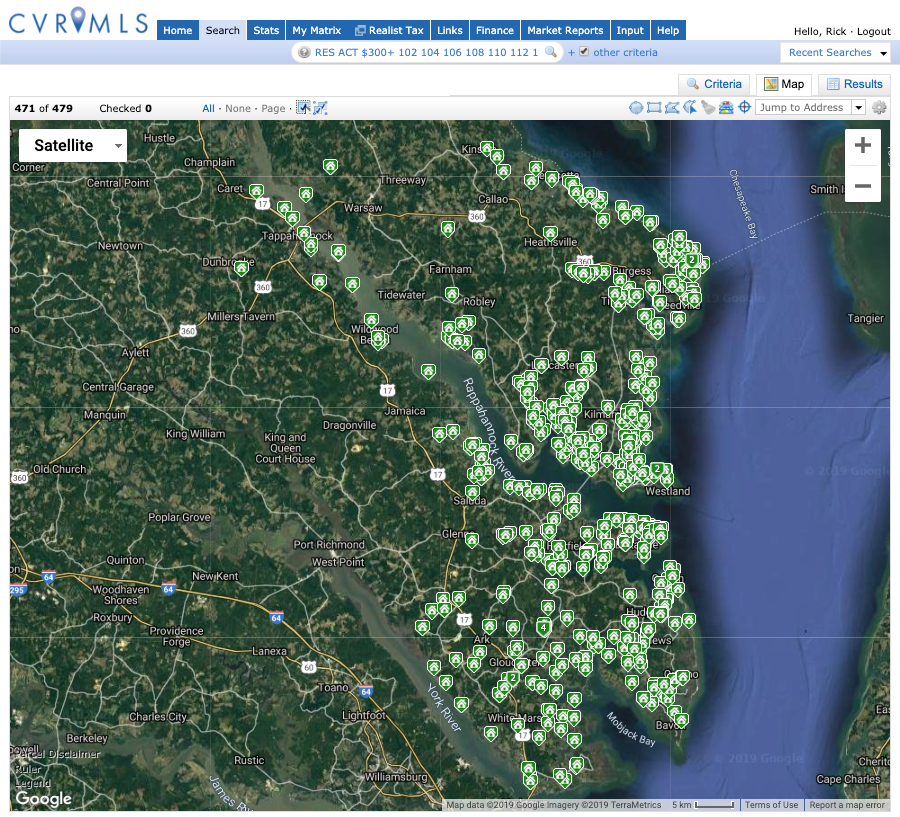

[su_box title=”Pro Tip | Multiple MLS’s at the Bay” style=”glass”]In most markets, a single MLS covers the entire area. Along the Bay, this is (unfortunately) not the case and it causes confusion for buyers who don’t realize the impact. Certain brokers only participate in one MLS and minimize the exposure for seller clients, and limit the access to available properties for their buyer clients – we feel this is a mistake. Since multiple MLS’s cover the region, it is critical to work with an agent who is a member of both to ensure you are receiving all of the information required to make the best decision.

The screenshots below show the difference in the coverage area for each MLS. While there is overlap, neither one contains all of the information.

[/su_box]

And to complicate matters further, many brokers/agents work only a small part of their time in our market and tend to not be a part of all of the MLS’s.

The net result is that the information you need to search is splintered and you need to have access to both Multiple Listing Services in order to make the best decision.

Guess what? We have access to all of the required MLS’s so that you don’t have to worry about missing a property because it wasn’t posted in all of the places it should be.

Zillow/Trulia and MLS?

Zillow sure is awesome isn’t it? The maps, the pictures, the estimates of value — they are all really neat features.

But what most people don’t realize is that Zillow (and Trulia, and Realtor.com), despite all of their really neat user interfaces and mobile apps, are not as accurate or reliable as the local MLS (Multiple Listing Service.) So not only do they not have as much information as MLS does, but they also do not receive it in real time.

Furthermore, there is no penalty for inaccurate or incomplete information on these sites like there is for MLS and thus, they contain information that can be outdated (at best) or intentionally misleading (at worst.)

The serious purchaser wants the best information and the only way to get it is through the MLS. Let us set up a Direct Search Link to the MLS. Only a licensed agent and member of the MLS can do this for you.

Comparing MLS to Zillow and Trulia

Zillow / Trulia | MLS | |

|

Sources of Information |

Trulia and Zillow receive their information from a variety of sources, but there are no penalities for false or dated information. |

Realtors collect and verify information before it is input to MLS and are required to updtate availability immediately. Substantial penalties exist for publishing incorrect information. |

|

Accuracy |

+/- 90% of available listings are usually delivered within 24 to 48 hours. |

97% or more, including other information such as homes under contract, recently closed, withdrawn from market, and expired listings. |

|

Advertising |

Builders, agents, and lenders can purchase higher placement of their listings or pay to have their information shown in every inquiry. |

Most MLS’s allow sponsors in an attempt to offset costs, but sponsors cannot impact results or rules. |

|

Enforcement |

None, really. |

Most MLS’s have 40+ pages of rules that agents must abide by to use the system. Penalties include fines and/or loss of access, which damage a Realtor’s career. |

|

Property Estimates |

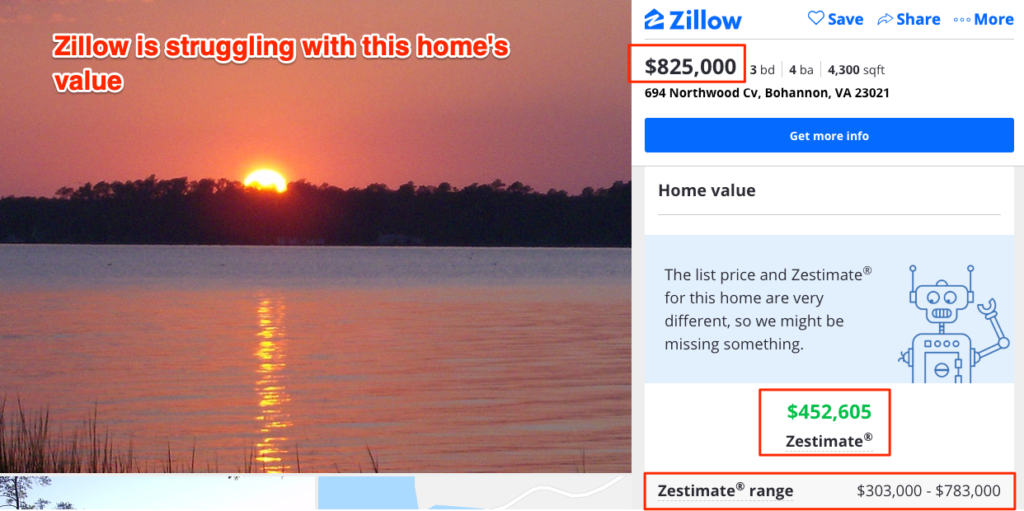

Zillow uses the Zestimate, which gives you an estimate of the home’s value. Properties along the water are extremely difficult to value for Zillow/Trulia. |

Many MLS’s offer a computer based estimate, too. Buyers should be able to see what homes are being used in the analysis for it to have any value. |

|

Results |

Zillow allows results to be skewed by paid advertising. |

Results from MLS are shown without bias and generally offer great sorting and analysis tools once the correct set of homes has been chosen. |

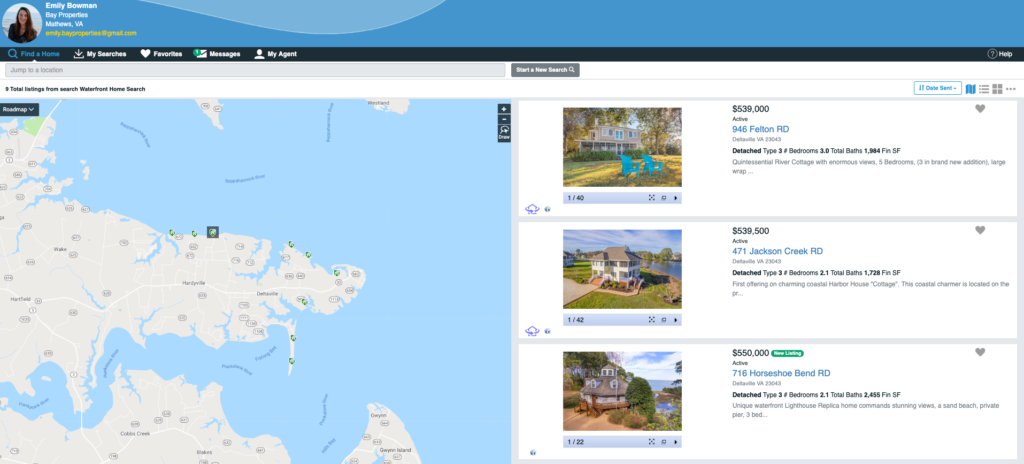

The Client Portal/MLS Direct Link

A direct link to MLS (screenshot below), provided by your agent, is the best way to go.

Not only will it contain more information and update in real time, but it also provides a great communication tool between agent and buyer. Likes and dislikes, scheduling and showings, notes and strategies — all are part of the MLS link.

Difference #2 –– How Homes Are Valued

For each of us, the value of a home differs.

Someone who lives to fish the deep waters of the Bay will not put nearly the value into a sandy beach as a family who’s kids love to spend their days playing along the shore.

For each of us, what we seek from our waterfront home is different.

So when you start your search, discussing the many types of valuations and how they differ is important. Why? Because every official valuation measures something different and when you get two valuations that seem at odds, it can be confusing.

The Types of Valuations

When people talk about a home’s ‘value,’ they are typically talking about its price. However, how a home is valued varies greatly depending on who (or what) is doing the valuation.

Fair Market Value

FMV is nothing more than the price at which a willing buyer and willing seller will exchange the asset. In theory, it should be the only value that matters. In reality, it doesn’t work that way.

Fair Market Value is really what all valuations are trying to approximate –– the problem is simply that FMV is subjective and thus, debatable. And thus the difficulty in there being a single value for a home that works for everyone.

Below is a discussion of the different types of valuations and what each one it attempting to measure, and why.

Competitive Market Analysis (CMA) | Accuracy Level = BEST

The CMA is the Realtor’s opinion of value through market analysis. A CMA is what your agent will use when they make recommendations on what a home is worth.

The CMA is derived similarly to an appraisal, with three big differences:

- Realtors are not governed by generally accepted appraisal rules and have more freedom to adjust to current market conditions, particularly in areas where prices are shifting quickly.

- Realtors can use information gathered from any sale, closed or not, in their analysis. Appraisers generally only use closed sales.

- Realtors know what you are looking for and understand your constraints and motivations. An appraiser is not necessarily in tune with buyer motivation.

At the end of the day, when a Realtor offers a well-researched and thorough opinion of value, it is generally the closest approximation to FMV. Why? Because a Realtor isn’t constrained in the same way an appraiser is, or the county assessor, or even Zillow.

Appraised Value | Accuracy Level = Good

When you use a mortgage to purchase your home, you will be required to have an appraisal. The lender will charge you anywhere from $500 to $1,500 to have a licensed appraiser prepare their opinion of value based largely on recent ‘comparable’ sales.

The biggest difference between an appraisal and a CMA is that an appraiser is constrained by a specific set of rules for how they select their comparable sales (i.e. COMPS) and what adjustments they are allowed to make.

What most buyers and sellers (and often times, agents) don’t realize is that a bank does not have to accept an appraisal, even when rules are followed. In markets where comparable sales can be challenging to find, appraisals are often contested and can cause deals to fall apart. So just be aware.

But in markets such as ours, a good and seasoned appraiser can be a valuable member of your team, even if you don’t plan on using bank financing.

Automated Valuation Model (AVM) | Accuracy Level = Undependable

As we discussed above, every real estate website these days contains a computer-generated estimate of value. Zillow’s “Zestimate” is probably the most common, but there are others.

Any computer algorithm is only as good as a) the information it includes and b) the variance of the inputs in the market. So when an algorithm uses incomplete and/or inaccurate information, as well as highly varied information, the output will be suspect.

AVM’s work really well when there have been numerous recent sales of homes with similar materials, similar age, similar size and design, and similar lot sizes –– and as you can probably guess, that DOES NOT describe our market.

Tax Assessments | Accuracy Level = Questionable

An assessment is the value assigned to a home by the town or county to determine the annual taxes.

[su_box title=”Pro Tip | Valuations and Time Between Sales” style=”glass”]The longer a property has gone between sales, the more its AVM’s and tax assessments tend to diverge from actual market value. Be careful using these measurements if the property hasn’t transferred in a decade or more.[/su_box]

Assessments tend to be lower than actual market values, especially in markets experiencing price gains. In our market, assessments are only re-evaluated every several years.

Generally speaking, when a home changes hands, the county will use the most recent sales price as the main input to the assessment. So if a property has transferred recently, the assessment will be a decent gauge of market value –– with the converse also being true.

The Bottom Line for Values

Water depth, views, sandy beaches, privacy –– all of these factors vary in importance to each buyer. Relying on any one measurement too heavily, especially the computer-generated ones, will not yield the correct result.

A good and experienced local agent is the best defense against poor or misleading valuations.

Leverage our experience in helping you to understand the difference in the different bodies of water, different towns, and different counties.

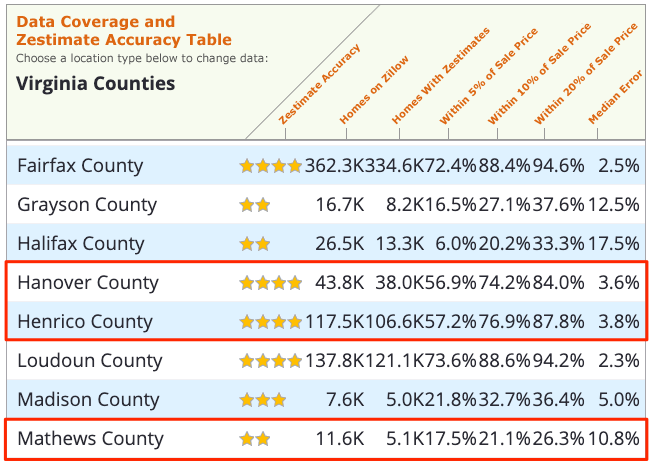

[su_box title=”Pro Tip | Zestimates and the Bay” style=”glass”]Most computer-generated valuations struggle when a property’s characteristics are highly diverse – and this is especially true along any body of water. Views, water depth, flood zones, lot sizes, and age of housing tend to vary greatly in our market and relying on a computer to tell you what a home is worth is a recipe for disaster. Zillow’s published accuracy tables for the counties of Eastern Virginia acknowledge their difficulty in predicting pricing in our region.[/su_box]

Difference #3 –– Flood Insurance

Some of the properties here are located in areas that are prone to flooding. It is important to seek guidance regarding properties located in a flood zone.

[su_box title=”Flood Insurance” style=”glass”]Flood Zones are determined by FEMA (the Federal Emergency Management Agency) and will determine what type of flood insurance is required for your home.

Please consult a qualified insurance provider to help you understand your Flood Insurance requirements.[/su_box]

FEMA (Federal Emergency Management Agency) has designated these areas, based on the likelihood and intensity of flooding, as Flood Zones, and the purchase of a home in a flood zone requires flood insurance (provided the home is to be purchased with a mortgage.)

The cost of flood insurance will vary based on the specific type of flood zone the home is located in and whether the home is a primary or secondary residence.

Difference # 4 –– Inspections

Septic Inspections

In most of the larger metropolitan areas, homes are connected to public water and sewage systems.

In our area, that typically is not the case.

For reasons related to density (or lack thereof) and minimal public infrastructure, the large majority of homes here use septic fields and wells.

For purchasers of homes on well and/or septic systems, separate inspections and certifications are required. Furthermore, with such a high water table (as you would expect along a river or bay), you tend to see more alternative forms of septic systems utilized.

Home Inspections

Proximity to water can be relaxing, but it requires more maintenance than in drier climates. And the closer you are to the big waters of the Chesapeake Bay, the saltier the air. Salt air can also impact the expected life of not just exterior materials, but of mechanical systems.

An experienced inspector in the Bay region is better than using one from your home market.

For the most part, being along a body of water simply means some extra maintenance items (especially on the exterior) and a few additional things to get inspected as a part of your purchase.

Difference #5 –– Docks

Odds are, if you currently live on a cul-de-sac in a planned community, or in a townhome Downtown, you don’t have a dock.

For many who come to the water, a dock is a necessity, especially if boating is part of the reason for purchasing a home here.

Docks, boat lifts, or other structures that extend into the water require an application and permit approval, the process of which will vary by each locality.

We typically recommend using a reputable dock/pier/lift company who is familiar with each county’s process if you wish to build, improve, or expand a dock, pier or lift.

[su_box title=”Pro Tip | The Cost of a Dock” style=”glass”]‘How much does a dock cost?’ is a common question we get. And the answer is ‘it depends.’Length, location, water depth, features, materials –– they all play a role in determining the cost of adding, updating, or renovating any structure that extends into one of the bodies of water along the Bay. [/su_box]

Securing a Mortgage

So you have decided you want to purchase a home along the water!

And while you wish it was your full-time residence (and maybe someday it will be!) as of right now, you will still spend the majority of your time living in your current home.

In mortgage vernacular, the place you really call ‘home’ is considered to be your Primary Residence, and the place you are purchasing along the water is a Second Home or Vacation Home.

How lenders treat each home differs, but maybe not as much as you might think.

Second Home Finance

The process of securing a mortgage for your second home (or vacation home) is not too dissimilar to the process when purchasing a primary residence –– the difference is more at the loan product level.

Down Payment

The biggest difference between the mortgage you have on your primary residence and on your second home will be down payments. In a primary residence, options exist that will allow you to put down a very low amount – sometimes as low as 3% – depending on the type of loan you qualify for. In a second home, the minimum down payment is 10%.

Interest Rates

From an interest rate perspective, the rates are essentially identical to the rates for primary residences. If you elect to purchase the home for income purposes, then an investment mortgage will be required. Most investment mortgages require higher down payments and interest rates.

The chart above shows a national average for several different types of mortgage products. We recommend consulting a local lender experienced in the differences in our market to get a current quote and discuss options.

Investment Loans

If you are planning on renting the property out for a majority of the time, then you are not purchasing a second home, you are purchasing an investment property in the eyes of your lender. Investment loans differ from loans for residences (either primary or second home) in both down payments AND interest rates. Tax treatment can also differ –– so consult your tax advisor if you plan on leasing your property to understand the impact leasing might have on your tax return.

Summary

Regardless of the route you choose to take, an experienced mortgage professional with access to a full range of mortgage products can help you understand your options.

Mortgage Product Matrix

The chart below is a simplified matrix showing some generally accepted best practices associated with the different types of mortgage providers.

Any reputable mortgage lender will have access to loan products from each of these providers of classifications.

| Conventional (Fannie Mae / Freddie Mac) | FHA (Good for First Time Buyers) | VA (Military/Veterans) | 2nd Home (Vacation) | |

|

Interest Rates* |

Best |

Good |

Good |

Same as conventional |

|

Credit Required* |

Most stringent |

Good, but not as stringent as Conventional |

Good, but not as stringent as Conventional |

Must qualify for both payments |

|

Down Payment* |

5% minimum, 20% to avoid mortgage insurance |

3.5% minimum |

0% |

10% |

*Loan programs change quickly and availability and terms can vary by region. The comparison above is for illustrative purposes only. Please consult a licensed mortgage originator to discuss the availability of these programs.

Types of Lenders

You will have many options for mortgage lenders when you decide to buy a home and each one handles the mortgage process differently.

Should You Call Your Bank?

Many buyers feel that they should simply call the bank where they have a checking account and ask to talk to someone in the mortgage department. This is not the best idea.

Your retail bank’s mortgage division is typically populated more by unlicensed call center lenders than licensed mortgage professionals. Since the bank holds the license, its employees are not required to hold their own. Furthermore, a retail bank often lacks access to the full range of mortgage products, thus limiting your options.

Using an Online Lender

The moment you open your laptop or mobile phone and do any research, you will immediately begin to see ads for mortgages from the likes of Quicken Loans, Lending Tree, Rocket Mortgage, and even Zillow Mortgage. And of course, they tell you that they have the best rates and the best service.

Here is what you need to know about Online Lenders.

- They do not have the best rates –– As a matter of fact, they are often higher. The low rates they quote are usually unavailable to the average buyer or they require you to close in a time frame that is unachievable. It is the classic game of bait and switch.

- They miss dates with frightening regularity –– And when they do, you pay the price. When you miss a closing date or other contract milestone, you can potentially set off a series of events that puts you at legal and financial risk. A local lender whose reputation is on the line will move mountains to make sure specified dates are met.

- They are often not even lenders –– They are often resellers of loan leads. Their goal is to get you to apply and then sell your information to a slew of mortgage lenders who will begin to harangue you mercilessly in order to try to secure your business.

- They use the cheapest service providers –– In order to try to offset the money spent on advertising, most online lenders try to make it up by using the cheapest service providers they can find. The most common abuse is using appraisers who don’t know the neighborhood well, but will work for cheap. Don’t trust your most valuable asset to anything less than the best available professionals.

- They don’t have skin in the game. If an issue arises, do you want to have a local professional or a 1-800 number with a 5 digit extension in another time zone? The answer is obvious. Online lenders do thousands upon thousands of loans in any given month and yours is treated as such.

Use a Local Mortgage Lender

Mortgage lenders specialize in one thing and one thing only: mortgages. Mortgage lenders differ from banks and online lenders in many ways:

Licensure — Each loan originator is individually licensed and required to undergo ongoing continuing education in order to maintain active license status. Furthermore, an originator’s license can be revoked for illegal activities, ensuring that the licensed originator you work with complies with all relevant financial regulations.

[su_box title=”Pro Tip | Don’t Let Your Lender Lose Your Deal” style=”glass”]Most experienced Realtors have had poor experiences with Online or Non-Local lenders. If you are in a market that is tight and likely to have multiple offers, please use a lender who is known to the local market. The rates are the same and the likelihood of you winning the deal increases substantially. [/su_box]

Product Array — Banks and online lenders cannot touch the depth and breadth of a mortgage company’s product line. In addition to the standard products provided by Fannie Mae, Freddie Mac, Ginnie Mae, FHA, and VA, mortgage companies have access to hundreds of additional products that might make more sense for your situation (i.e. Doctor Loans, HELOCs, Grant Programs, etc).

Local Local Local — Why do Realtors tend to recommend local lenders? Because each time a local lender makes a commitment, they put their reputation on the line. In any real estate transaction, each party is counting on the other one to do their duty and when one side fails and the transaction crumbles, reputations are damaged. Using a lender and agent with a reputation for deals that close on time and with minimal effort can help you secure the property you want at the best price and terms.

Summary (and Thanks for Reading!)

So, are you still curious about homes along the Chesapeake Bay? Have a question we didn’t answer? Contact us!

Hopefully, you found this deep dive on the bays, creeks, and rivers of the Chesapeake region helpful in your search.

We work here, we live here, and we play here … and we would love to help you find the perfect place.

Let our experience and knowledge become yours.